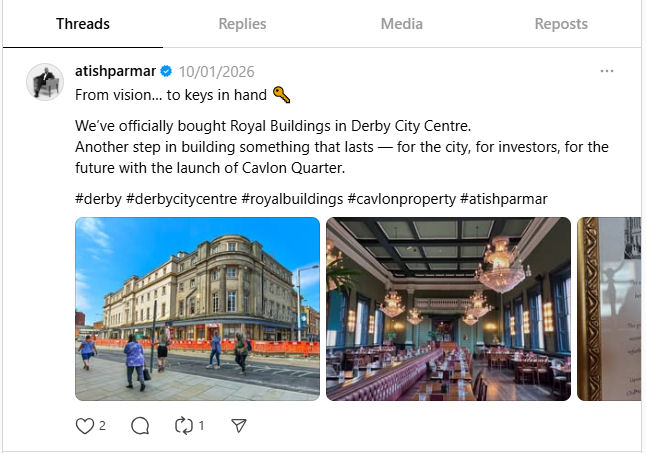

In January 2026, the Royal Buildings in Derby city centre, was sold to Cavendish and London Property Group Ltd. It was sold by Clowes Developments for an undisclosed sum. The Buildings is home to a number of organisations, including the Cosy Club.

Who is Cavendish & London Property Group Ltd?

Contrary to the landing page on its website, it is not based on Regent Street in London. The nearest it gets to London, is 100 London Road in Leicester. Its erstwhile Registered Office and home to the Mega Oriental Market.

Prior to the Mega Oriental Market being established, it was the offices of Century Estate Agents Ltd. The now dissolved company, was owned by Atish Arvind Parmar, who is also the owner of Cavendish and London Property Group Ltd. Just a few minutes away he owns the building with the Bubble Tea shop.

Corporate History

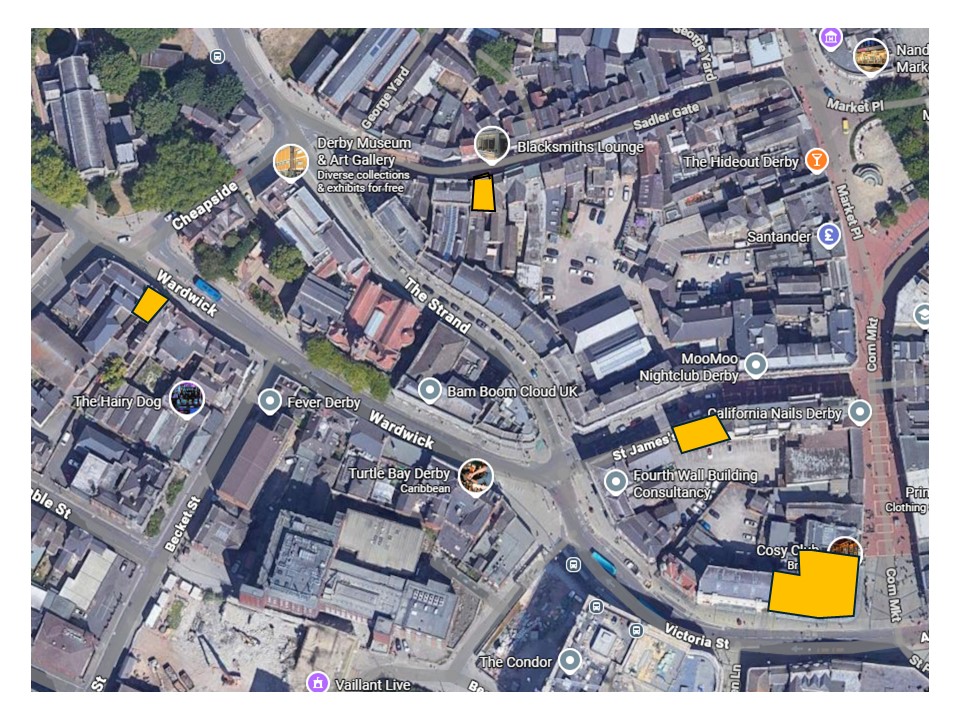

Cavlon (Parmar’s abbreviation for his company) was incorporated on 17 May 2016. It’s first year of commercial activity was the year to 31 March 2019 when it bought 3 adjacent properties on Curzon Street, Derby for £483k.

Over the next 3 years little happened apart from a revaluation of the properties adding an additional £421k to the balance sheet. Without this, the overall balance sheet would have been negative; the company was generating small annual losses and was technically illiquid.

In 2022/23 it bought the previously mentioned properties on London Road, Leicester, and 59 Wardwick in Derby for a total of £1.545m ( all funded by bank borrowing and additional share capital) – still no profits reported.

In the following 2 years to 31 March 2025 it started to invest in Derby City Centre properties:

A planning application was submitted on 28 February 2025 to convert the upper floors of the building into 15 apartments. Planning permission has still not been granted; it is being considered alongside the application for the later acquisition of 14-16 St James Street. Formal extension of the planning application process has been granted until 28 February 2026. The ground floor is available for rent from May 2026 at £25kpa. It will have taken 2.5 years to achieve planning permission from purchase, if granted!

In a Marketing Derby article from February 2025 Cavendish was planning to have the 6 residential units in the upper floors of 40 Sadler Gate available by Summer 2025. Planning permission was granted on 6 May 2025 ( the application was submitted on 21 January 2025). Its website now states Summer 2026. The ground floor is currently empty and on offer for rent at £15kpa

The planning application is to convert the 4th floor into a single apartment. Planning permission has not yet been granted.

All of these properties remain largely unoccupied.

Where is the money coming from?

The expansion of Cavendish has been through borrowed money (mortgaged) and some share capital. There has been no profit to invest.

It is interesting to note that, on it’s website, it now offers a public investment options.

These are very high risk investments for any individual, reflected in the interest rate offered. The debt repayment over 2-3 years requires a rapid turnaround of the property into a high revenue generating unit.

Royal Buildings – new venture

Originally the Royal Hotel, it dominates the corner of Victoria Street and Cornmarket. This is a significant undertaking to manitain the heritage value of the building and to develop it as a valuable place in the heart of the City Centre.

“Cavlon Quarter“

Parmar has fashioned a region in the City Centre which he has named the “Cavlon Quarter” comprising a number of shops and flats. This is not an official title.

The company, Cavlon Quarter Ltd, which was incorporated on 24 October 2025, owns the Royal Buildings ( with mortgage)

Comment / Opinion

The accumulated profit of the company, after 6 years of trading is just £20k.

In a Marketing Derby article (19th February 2025)

“For many years now, Cavendish & London Property Group has been breathing new life into existing buildings in Derby city centre to create high quality commercial space and luxurious apartments. Managing director Atish Parmar confesses that the firm’s first project in the city was a “gamble” – but here, in his own words, he explains why investing in Derby is now definitely a chance worth taking.”

The only properties that have had life “breathed into them” are the Houses of Multiple Occupancy (HMO) on Curzon Street and on the Wardwick. The rest are just pipe dreams.

“Cavlon” is not profitable, it does not generate cash, it has little experience of delivering major projects at pace. The use of the self-styled “Cavlon Quarter” tag, indicates the extent to which this appeals to Parmar’s vanity rather than being a serious contribution to the City.

The funding opportunity to lure in unsuspecting investors at such interest rates is the hallmark of high risk investments. If the organisation was peforming, then banks would lend at lower rates. Given the very slow turnaround of these properties it will not be generating enough cash to create the commited returns to the investors. Other developers have tried this methodology and failed. Previous articles on the collapsed Godwin group

The Royal Buildings has some impressive spaces, especially the Cosy Club. These need to be nurtured and developed sympathetically. Cavlon’s skill set seems to be converting buildings into HMO’s. The planning application for the Royal Buildings is eagerly awaited.

The real risk is that “Cavlon” will run out of money before it has a chance to generate any revenue. Watch out for the “white knight” on the horizon!

Postscript

The abbreviation and concatenation of the company name to create “Cavlon” is convenient but unfortunate. It sounds more like a brand of antiseptic cream rather than a high-flying, dynamic developer!

Categories: Uncategorized