The Loan Note Holders (LNHs) of the Godwin Group, which collapsed, catastrophically in mid–2025, will be waiting, with anticipation, the January report from the Liquidator, MHA. Will there be any hope of a meaningful payout? Will there be any clues as to where it all went wrong and where the money is? Will the Directors be held to account?

Initial reports have already provided much insight into the affairs of the Godwin Group which were previously not clear.

It is a tale of bad luck, incompetence, deception, greed, fraud and theft.

Previous Derby News articles on Godwin group

The seeds of the collapse of Godwin Group started just over 7 years ago.

In 2018, Godwin was a small time developer; it had gone bust in 2013. Its experience had been a handful of small housing projects/roadside retail outlets in various partnerships. The whole “group” had generated a cumulative loss of the order of £5-£6m. It was not a profitable enterprise and it was technically illiquid.

By 2018, it had

- purchased the Agard Street car park in Derby for £0.35m, and submitted a planning application to convert it into 142 student flats. It had met with some push back from Derby City Council

- recently borrowed £1.5m from LNHs through Godwin Capital No. 1 Ltd on 3/5 year agreemeents offering 9% pa interest. The Security Trustee was Callidus Properties.. This was borrowed by GC no. 24 Ltd to fund the conversion of the Ram Jam Inn on the A1 into another roadside retail outlet.

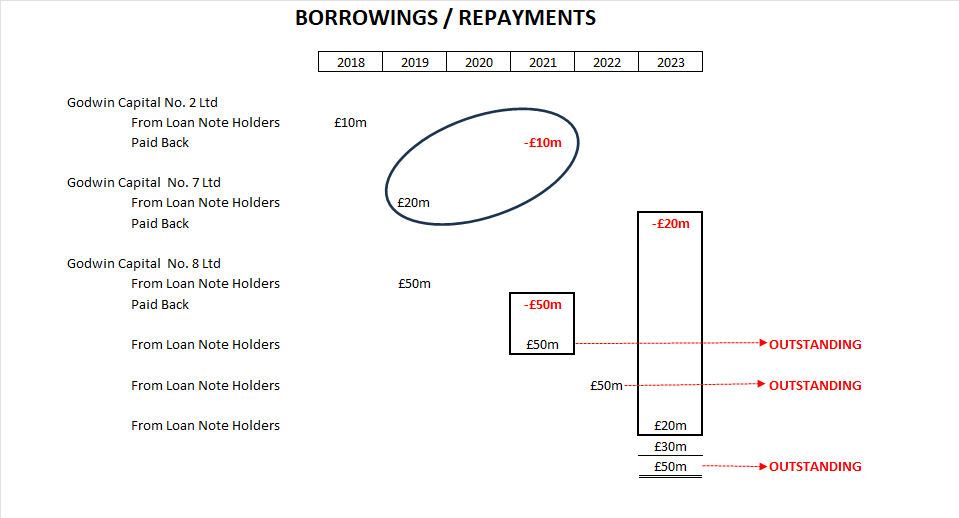

- incorporated in April 2018, Godwin Capital No. 2 Ltd and issued 2 year Loan Notes offering 10-12% pa interest, to the value of £10m.

- submitted a planning application to convert a car park into Derby’s tallest building – the Landmark, requiring £30m funding. A venture well beyond any of its previous experience. Due to its location near a World Heritage site it was referred to the Secretary of State.

In February 2019, Godwin Capital no. 7 Ltd , issued a further £20m of Loan notes with Blue Water Capital as the Security Trustee on a 2 year term with interest rates of 10-12%. This, combined with previous funding, provided the £30m that was necessary to build the Landmark project.

It needed to move fast to generate enough cash to pay off the loan notes, the interest and the substantial commissions.

It was clear that these few projects were not going to deliver, soon; the newly incorporated Godwin Capital No. 8 Ltd issued £20m of Loan Notes, with Blue Water Capital as the Security Trustee.

By mid-2019, Godwin group had borrowed a total £50m from LNHs with a very small portfolio in place – a few car parks, and planning applications in process. There was no evidence that the projects highlighted on their website, or the investment prospectus, required £50m; it far exceeded the project costs.

By the end of 2021, £60m of these Loan Notes had to be paid back. On 12 October 2021, Godwin Capital No. 8 Ltd borrowed a further £50m from LNHs with a 2 year term and interest rates of 10-12%. This allowed the repayments to be made.

Losses were building, interest and payments needed to be paid. A further £50m was borrowed by Godwin Capital No. 8 Ltd from LNHs in 2022 and then again in 2023; some of which paid off the £20m of Loan Notes from Godwin Capital no. 7 Ltd.

A spiral of significant business losses, commissions, interest and capital repayments fuelled this race to borrow more money which started to creak in late 2024, and finally ran aground in mid-2025.

There were 36 employees and a substantial net liability on the combined balance sheets

Comment

A generous interpretation of the events was that their plans to build Derby’s largest building was undermined by the planning process and Covid. By their own admission, they needed to have moved fast to make the project work. The £30m was being burnt up rapidly and no income was being generated. Despite pouring more money into the Agard Street development to secure the planning permission they opted to sell the package to a builder to get some income, albeit small – time was not on their side.

The Ram Jam Inn project was beset by delays and planning issues – the property is still on Godwin’s books – 8 years later.

The need to maintain confidence in its ability to make payments on time ( an explicit selling point for new LNHs), resulted in further loan note issues. This also fuelled the increase in staff numbers, to generate more leads, more projects and more hope that some would come to fruition and generate regular income or a sizeable lump sum profit.

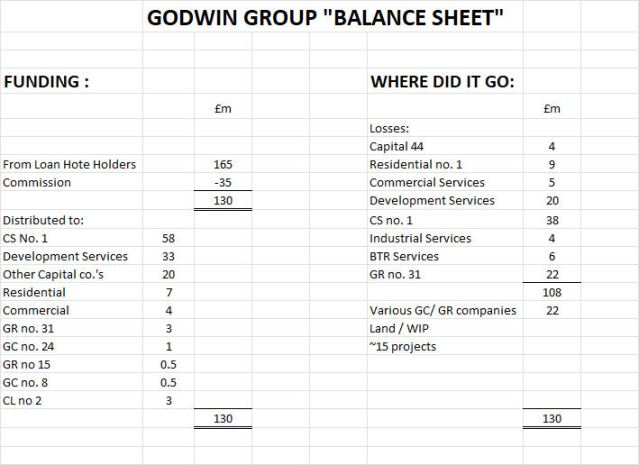

Whilst much of the losses will inevitably result from bad luck and incompetence this could not explain the vast majority of the group net liability. Much of the £165m missing money is not explained by the poor trading position

Other sources of finance

“The Security Trustee will also hold a first legal charge on behalf of the LNHs over the properties purchased by the Special Purpose Vehicles (SPVs) of the Issuer (Godwin)”

The term sheets for the loan notes stated that loans would be secured by a 1st Legal Charge on the property purchased through any of the SPVs. As early as May 2018, GC no. 24 Ltd signed an agreement with Callidus Properties which gave it a 1st legal charge over Ram Jam Service station by issuing 3/5 year loans with 9/10% interest rates.

In 2020 Godwin signed up with Together Finance to fund the purchase of the car park that was due to be the Landmark building through GR no. 2 Ltd. Over the next 4 years a further 9 properties used Together Finance funding to purchase properties billed as being secured by funding from Godwin Capital no. 8 LNHs.

The first significant indication of concern to any potential investor/advisor was on 16th August 2023. It should have raised alarm bells!

- CL No. 2 Ltd had submitted a planning application on the Angel Drove, Ely site on 1st April 2021. It took 2 years before the planning permission was granted. Shortly after that was granted, Godwin needed to buy the land. The following actions suggested that it had serious liquidity issues.

- On 16th August 2023, the Godwin group signed five 2nd legal charges with Together Finance (it already had 1st legal charges with it). These were with GR No. 2 Ltd, GR No. 18 Ltd, GC No. 27 Ltd, GR No. 30 Ltd and GC No. 26 Ltd as “chargors”; ie each company provided its property as security for the loan to CL No. 2 Ltd. In total this raised just £983,210!

- CL No. 2 Ltd also took out a loan for a further £2.91m. This, together with funding through Godwin Capital No. 8 Ltd of £1m, secured he land purchase of £4.915m. This land, with planning permission, was then sold to Jersey based Campion Propco 2 Ltd for £9.9m

- On 30th June 2025, as the Godwin group went into administration, all of the above Together Finance loans were paid off in full, leaving an inflated amount of £3m owing to Godwin Capital No. 8 Ltd. As the company had sold the land there were no assets to pay off the outstanding inter-company loan. There is no trail, publicly, as to what happened to the surplus of £5m.

A similar action was taken on 23rd May 2024 where monies were borrowed from Together Finance to buy the Maple Fields property through GR No. 9 Ltd. However the assets given as security were those of GC No. 26 Ltd (Erdington). This loan was also fully paid off on 30 June 2025.

The above actions took place a few months after the final Godwin No. 8 Ltd £50m Loan note issue on 26th May 2023.

Where did the money go?

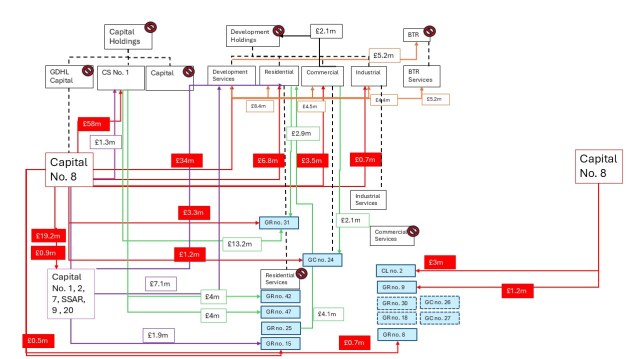

Funds rarely flowed from Godwin Capital No. 8 Ltd directly to a SPV ( unlike the process described by Godwin). The 2 main recipients were CS no. 1 Ltd and Godwin Development Services Ltd; these were the administrative companies that employed the 36 staff and which held the significant losses. Money going into publicised projects was relatively small as the majority of the property purchases were funded by Together Finance.

Godwin LNHs were funding the costs associated with developing and securing the planning permission. Typically this was the sale point with limited profit; only a few projects were taken to full build completion.

Derby News has generated an outline “net” Funds Flow statement based on published information.

GR no. 31 is an interesting example of disappearing assets.

GR No. 31 Ltd had no obvious connection with any of the publicised development projects. By 31 March 2024 it was showing on its balance sheet, £22.3m of “stock” ; this had grown over the previous 2 years. This was offset by liabilities of £22.3m. In the statement of Affairs dated 16th October 2025, the liquidators declared that it had no assets (“uncertain”) and just £8.10 in the bank. There were creditors outstanding of £19.5m most of which were loans originating from Godwin Capital No. 8 Ltd

If the “asset” had existed and had been sold it was not used to pay the primary creditor, Godwin Capital No. 8 Ltd

The liquidator, MHA, has access to the financial records of most of the relevant companies which were conduits for the money. The top level holding companies, which are directly owned by the 4 Directors, and which were most likely the primary exit points for cash, remain inaccessible and blind spots for the liquidator.

Comment

Was it a Ponzi scheme?

A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organisers often promise to invest your money and generate high returns with little or no risk. But in many Ponzi schemes the fraudsters do not invest the money. Instead they use it to pay those invested earlier and may keep some for themselves. With little ot no legitimate errnings, Ponzi schemes, require a constant flow of new money to survive. When it becomes hard to recruit new investors or when large numbers of existing inestors cash out, these schemes tend to collapse.

Godwin group did engage in genuine purchases of land and attempted to trade as a developer – “with little or no legitimate earnings”. The evidence is that it is highly likely that previous LNHs were paid with new LNHs money, invested on the back of the promise of high interest rate, and low risk returns. A classic Ponzi scheme!

Schemes were built and sold. The level of business did not require anywhere near £165m to fund it. The main problem from the outset was that the time taken to develop any project was much greater than the loan repayment term periods and the profits were woefully insufficient to cover, commission, interest and a return to the shareholders.

The reality was that the business model was inherently loss-making and could only have been a vehicle to defraud investors and creditors.

In the marketing material, Godwins inflated the perception of the returns by quoting Gross Development Values ( for fully built schemes). This may have been an aspiration from the outset but the reality was that their model was to sell land just after planning permission was granted. This would have required a much greater volume of projects and much swifter turnaround.

It is clear that they bought up land with fanciful ideas for development but due to poor execution during that phase the road to getting planning permission was long and tortuous.

A majority of investors were encouraged to invest by the exaggerated claims in the prospectus and ill informed and greedy advisors chasing generous commissions who claimed due diligence but who had barely read the published accounts.

A considerable amount of money was spent on the salaries of 36 highly paid individuals who delivered very little for LNHs. They would all have been very aware that the public statements and glossy brochures were not supported by objective facts.

Derby News called out the fraility of this business in March 2019. Anyone claiming due diligence should have had no doubt at the end of 2021 that this was a failing venture.

Derby’s new Landmark building: Questions to be asked about the Property Developer, Godwin “group”

This collapse was either the consequence of coincident and collective incompetence of a wide range of independent people or a conspiracy of a few who exploited personal greed, the lure of unrealistic expectations and an impenetrable web of half-facts, faux legality, complex corporate structure which rendered any investment an act of faith rather than based on a cold, transparent business decision.

The Godwin Capital No. 8 Ltd LNHs will be struggling to come to terms with their loss. These are not institutional investors, pensions schemes, and billionaires who, for which, these losses are an occupational hazard, but many ordinary people who saw a well-articulated, but ultimately deceitful, opportunity, promoted by professional advisors, to make a sound investment – in some cases with their life savings!

The next Liquidators report will put further flesh on the bones of this whole mess however without access to the complete array of Godwin companies, and the Directors’ bank accounts, a full forensic analysis of where the money finally went, and truly determing whether it was fraud or incompetence, will be impossible to determine..

Categories: Godwin

The directors stole money off innocent people to fund their lifestyle, first class trips to America, Christmas at the four seasons in Portugal, children attending private school, (Solihull and Highclare) top of the range sports cars (range rovers, Ferraris, Defenders) nannies for their children. They should be put behind bars, lets hope they plead guilty to Godwin being a PONZI scheme because that’s exactly what it was.

Sounds like you have some good insight. Do you have details that you could share?

I have a great insight on the two Pratt brothers including where they live.

Can you email me details directly at russell.pollard@btinternet.com. Thanks