On the 16th August 2024, Deda announced that it was entering Voluntary insolvency procedures

“This difficult decision comes after enduring significant financial pressures since the onset of the COVID-19 pandemic.”

One month earlier, on the 19th July, Steve Slater, the CEO and Artistic Director, declared that he was leaving the organisation after joining in March 2020.

In the last published set of accounts (31 March 2023), there were 16 Trustees named, 4 had resigned during that financial year. Since 31 March 2023, a further 12 Trustees have resigned leaving just 4 in June 2024. 5 have joined since then including 2 Derby City Councillors ( Cllrs are routinely on the Board as “observers”)

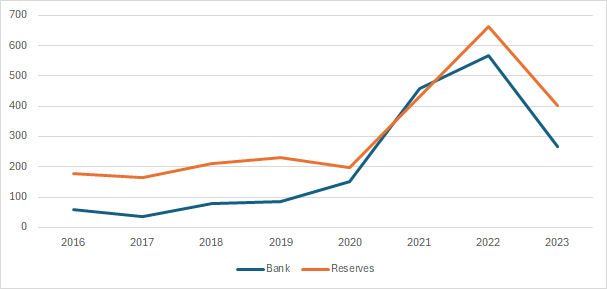

In the 3 full years prior to COVID-19, the annual income was around £1million; the overall surplus for those 3 years was just £34k. The bank balance at 31 March 2020 was £152k with reserves being £197k.

The Deda building is leased from Derby City Council; the rental is fixed at £7k pa.

Deda is an Arts Council National Portfolio Organisation and receives an annual grant of £350k. Derby City Council (DCC) provided an annual grant of ~£50k pa. According to the published accounts this stopped in 2019 and 2020 and was re-instated for 2021 and 2022. There is no indication of any grant from DCC for 2023.

In the 2 years of COVID-19 ( 2021 and 2022), the bank balance increased to £566k, and reserves £664k (31 March 2022). This was helped by £431k of one-off COVID-19 funding:

- Arts Council – Re-emergence fund £202k

- UK Govt – Job Retention scheme £156k

- UK Govt/ Derby City Council – Business grant £34k

- Esmee Fairbairn Foundation – core funding support £39k.

Deda was well positioned for the first full year post COVID in the year to 31 March 2023.

Income from Charitable activities – performances, classes, cafe, room hire continued to increase from £335k in 2022 to £417k in 2023 – 25% increase! However:

- Grant funding plummeted from £746k (2022) to £383k (2023) – £363k reduction (- 48%)

- 6 extra staff were recruited ( from 29 to 35 – + 21%) increasing the staff costs by £143k (+32%).

This turned the £230k surplus in 2022 to a £260k deficit in 2023; a significant impact of £490k. The bank balance was depleted to £267k and the reserves £403k

Non-staff costs increased by £67k (+16%).

No information has been published that covers the year to 31 March 2024.

Comment

Many organisations benefitted from generous grants during the 2 years of COVID; Deda was no different giving them the opportunity to build up reserves and secure their future. Just prior to COVID they secured 3 year grants from private funders which contributed £85.5k pa; these ended in 2022.

All charitable organisations have to develop and shape their “offer” based on what they can fund and afford. No organisation has a right to exist at an unsustainable level.

Deda’s post-COVID offer attracts around £800k of income; just under 50% is supported by the Arts Council. That implies that they need a cost of base of a maximum of £800k. In 2022 they spent £850k. For reasons best known to the Trustees, they made decisions to grow the cost base in the absence of any evident agreements to fund it; with the inevitable consequences. It can only be assumed that this spending trend has continued over the last year.

Within the Trustee’s report section of the annual Financial Statements, it states within the Reserves Policy and Going Concern paragraphs:

“The trustees have undertaken a review of major risks to which the charity is exposed. Deda does not take forward a project until funding is secured. Therefore should there be a shortfall on income, related expenditure would be reduced and the scale of project would be revised accordingly. The charity constantly monitors its core activity costs against available core funding income throughout the year through budgets and forecasts.”

This clearly did not take place and poor financial and business planning is the most likely reason for the insolvency proceedings rather than COVID-19, the cost of living crisis, or Council funding. This might explain the mass exodus of Trustees in the last 18 months.

Categories: Uncategorized