In its latest annual report, St James Securities, the Becketwell developer reveals:

“Athough demand for a Multi-Storey Car Park (MSCP) and a hotel is high, cost viability is a major issue without significant intervention”.

“…our attention is focussed on other developments which are more deliverable…there are enquiries from Food & Beverage providers. The Group will seek to explore those opportunities over the coming months”

Th re-development of the Becketwell area always contemplated a MSCP and Hotel. An extract from the December 2019 Design and Access Statement, produced by St James Securities as part of the outline planning application, concluded:

Whilst a car park was excluded as part of the specific Becketwell Performance Venue (BPV) planning application in July 2021, the documents did recognise the option of a MSCP on the site of the old Pennine Hotel – adjacent to the BPV. It also included the option for a “potential Hotel” on Site 2A.

The BPV planning application dismissed the immediate need for a car park on the basis that there was sufficient capacity within walking distance.

Since this was published in 2021, the Riverside Car Park (772 spaces) has closed, a planning application has been approved which will reduce the capacity of the Derbion basement car park by ~50% (1300 spaces) and the Assembly Rooms car park will be demolished (214 spaces).

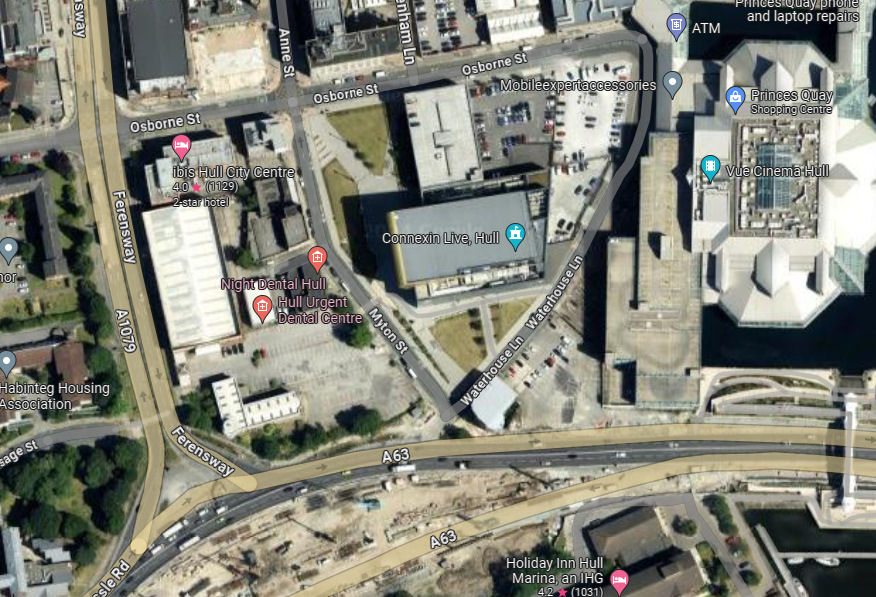

The BPV was originally compared to the Hull Bonus Arena (now Connexin Live) ; both with a 3500 seat capacity.

The Hull venue has significant car parking immediately adjacent to it.

Comment

Common sense suggests that a modern Performance Venue should be serviced by suitably convenient car parking to optimise its viability. With the BPV being surrounded by less than salubrious side streets it will not be as attractive to those who are anxious about late night inner city walking.

The original argument of ample parking within a 9 minute walk, has been undermined by a disjointed planning system which has subsequently allowed the closing of car parking capacity.

It is not a surprise that a developer makes decisions based on commercial gain.

It is also no surprise that general concepts stated in the approved planning application turn out to be disposable whims and that Derby will not benefit from the execution of a coherent integrated plan but one that conspires to benefit the short term aspirations of St James Securities’ 2 shareholders.

Categories: Uncategorized