In July 2020,the Leader of the Council, Cllr Poulter, announced that St James Securities (SJS) had made a proposal to build a Performance Venue (BPV) on the Becketwell site for a fixed price of £45m – taking all of the development and cost risk. This was well in advance of any of the specification being agreed other than a high level seating capacity number and it’s broad similarity to the Hull Bonus Arena.

This was subsequently confirmed in a Public Contract award notice dated 18th May 2021 at a value of £45.8m. The legalities of the arrangement were embodied in the Forward Funding Agreement in early 2022.

At the Regeneration Scrutiny Review Board on 18th October 2022 Paul Morris, Director St James Securities, made a brief appearance by video. In his statement he confirmed that the project had been:

“entirely de-risked from the Council’s point of view…(SJS) put all of the risk money in to start with…and taken all of the development and contracting risk which in the current climate with cost price inflation was a wise move for the City Council but it is something we are used to mitigating”

The project is not “entirely de-risked from the Council’s point of view”

It is true to say that SJS incurred all of the pre-contract costs over the last 2 years, “at risk”. These have now been reimbursed by Derby City Council in a payment of £1,818,746 to SJS on 20th May 2022.

The Forward Funding Agreement allows SJS to recover incurred costs from Derby City Council, on a monthly basis. This means that the £45.8m contract cost is covered on a “pay as you go” basis; there is no ongoing financing risk to SJS.

When Morris mentioned about the cost price inflation and the “wise move for the City Council” he paused briefly for a nervous laugh. His confidence over mitigating double digit inflation may be premature.

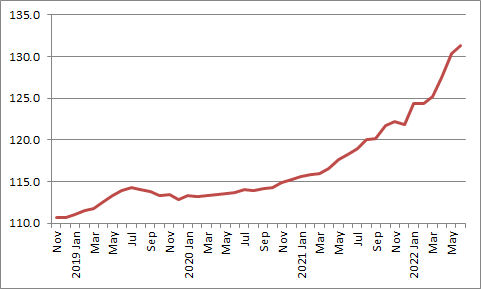

- The Hull Bonus Arena was built in 2018 for £36m. Assume a 10% profit , so a contractor cost of ~£32m. The construction output price index from 2018-2020 rose by 4%. Adding in land related purchases for the BPV then an uprated cost based on the Hull Arena would be £34m for the BPV bid. Assume ~10% profit , and ~10% project contingency plus £1-2m for inflation results in a total contract cost of ~ £45.8m.

- The index from mid-2020 to mid-2022 rose 15% – this will increase costs by ~£5m. The project will take around 2.5 years to complete – inflation could be at least 20% (£8m) over that period. This will wipe out the profit, contingency and inflation reserve completely for SJS.

The only way that SJS could mitigate this extent of cost inflation is to significantly de-scope the project. E.g: Reduced seating capacity, reduced facilities, cheaper fittings etc.

If SJS can’t mitigate the cost sufficiently then they will be in a position where they’ll need to take the overspend hit into their accounts. SJS is not a large company – the group’s Net Assets in the last set of accounts (30th Sept 2021) was £1.8m – Becketwell is their only project!

A loss of a few million will take the SJS group into negative net worth; the group was already in an uncertain financial position.

The only other options if there is an overspend would be:

- Derby City Council agree to pay more than £45.8m for the BPV – undermining the notion of a “de-risked” project for DCC.

- A 3rd Party lender supports SJS with financing. However as SJS will have no means to pay the loan this could result in a takeover. In October 2021, Peveril Securities (investment and development division of Bowmer & Kirkland) lent SJS £1.95m to pay off existing loans and provide working capital. This is secured on the SJS business.

- Peveril Securities became a development partner in early 2022 – “Peveril Securities announced as development partners for £200m Becketwell Derby Scheme”

The BPV is not the only project risk being covered by SJS

SJS signed a 2nd Fixed price contract with DCC in July 2020 for £1.8m to build a new Public Square ( on the site of the old United Reform Church). For the period up to September 2022, SJS has been reimbursed £753k by DCC for the work prior to on-site commencement ( ground breaking September 2022). This should be completed in Spring 2023.

This contract will also be compromised by inflationary pressures.

Comment

In July 2020, SJS used the idea of a fixed price arrangement as a “sweetener” to the Council; a Council which, at the time, was still reeling from a failed Assembly Rooms refurbishment policy ( and the massive overspend on the A52) – they needed a way out. Even though the Council had no visibility of what would be delivered, they agreed to partner with SJS – SJS was already heavily committed to the whole Becketwell project. It was not a new private sector partner.

But SJS didn’t expect the inflationary pressures from the fall out from Covid, the war in Ukraine, and Truss’ failed mini-budget. The inflationary pressures are at great risk of bankrupting SJS. The worst case scenario for the Council is that it’s left with a partially built venue which is then completed, at a highly inflated cost, by a 3rd Party.

Although SJS has been paid £3.451m by DCC under the FFA ( ~50% is the pre-contract initial costs) , it is clear that the project is behind schedule. The demolition works are close to completion but this can operate independently of the construction phase. This delay will further exacerbate the inflationary pressures.

The fixing of a price with no specification is a flawed and high risk model for all concerned and is likely to result in a messy project and some corporate restructuring.

SJS, as a developer, had been “sold” to key stakeholders, including Councillors, as a “major developer from Leeds”.

“Over the years we have established an enviable reputation for delivering ambitious developments…Following a management buy out in 2013, our current focus is the identification, acquisition and delivery of urban regeneration and retail warehouse schemes.”

Marketing Derby article https://www.marketingderby.co.uk/bondholders/st-james-securities/

The major projects it often promotes in its publicity, were delivered as part of Joint Ventures with other developers prior to 2013; at which point SJS had net liabilities of £8.7m ( insolvent). It had to be “restructured” as part of the management buy-out. Since 2013 it has delivered just 3 projects:

- M&S Simply Food shop (Harrogate),

- Morrison’s supermarket (Ilkeston),

- St James Retail Park (Sheffield).

Since 2018 the sole focus has been Becketwell.

Having just one project and one customer is high risk. Does SJS really have the corporate experience to deliver this whole regeneration project? Do they have sufficient financial strength to cover the emerging risks? When will the risks to Derby City Council crystallise?

This project was always high risk for the Council – the issue is that no one has recognised it yet…

Categories: Uncategorized