In the previous article “Godwin Developments’ “Ponzi” scheme collapses raising many questions” it was highlighted that the Advisers to potential investors failed in their duty to carry out thorough due diligence in support of their advice.

Godwin Capital no. 8 Ltd (now in Administration) started issuing 2 year 10-12% interest pa Loan Notes in November 2019 to raise £50m. These matured in November 2021 when a 2nd round of Loan notes was issued to raise £50m.

This was on top of £20m of Loan notes issued by Godwin Capital no. 7 Ltd and £0.5m by Godwin Capital no. 6 Ltd , both of which were due to mature and be repaid

The end of 2021 was a pivotal time for Godwins; they needed money! And were prepared to pay for it.

This was the opportunity for 3 critical questions to have been asked by Advisers. The simplest of due diligence.

1. What projects have been delivered in the last 2 years, and how much revenue was generated?

[ The business model worked on the basis that the £50m borrowed in November 2019, was invested in development projects, generating sufficient return to pay back the Loan Note Holders, including the 10-12% interest, the Advisers/introducers commission (~20%) and a profit for the Godwin shareholders. Revenue of the order of £70m+ would have been required to ensure that there was a sensible business proposition and that Godwin remained as a “Going Concern”

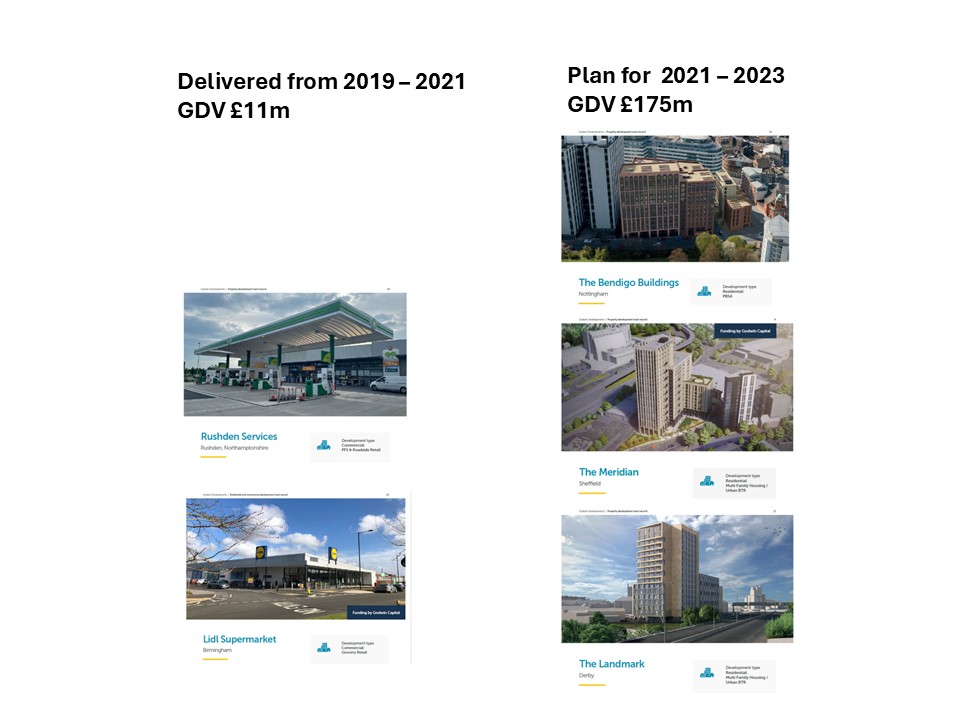

In the September 2021 “Property Development Track Record” issued by Godwin, 28 property developments were presented.

At that point, 10 of the projects had been completed, 8 prior to 2019, leaving just 2 deliveries between 2019 and 2021. According to the Godwin document these had a combined Gross Development Value (GDV) of just £11m!

Gross Development Value (GDV) is the projected value of a property development once it is completed – fully built. NB: For most projects Godwin exitted when the planning permission was secured. The actual build of the scheme was done by the buyer. In this respect, the GDV was meaningless to investors.

The 2 that were delivered were:

- Lidl, Kings Heath – GDV £8m

- whilst Godwin Developments were involved in the planning application, the land was bought by Brampton Vale (KHeath) Ltd ( not owned or controlled by Godwin directors) for £2m on 21st March 2019. Winvic were responsible for the construction of the building which was sold by Brampton Value for £8.3m to Knight Frank Investment Management. Godwin Developments would have received a fraction of that sum for “services provided”.

- Rushden Services – GDV £3m

- Godwin company, GC No. 21 Ltd bought the land for this development in January 2020, (GC No. 21 Ltd wasn’t incorporated until 7 June 2022!) following planning approval. It was sold to LondonMetric Property for £2m in May 2020.

In summary, the net return to Godwin from these 2 sales in the 2 year Loan Note period 2019-2021 would have been <£5m – not sufficient to pay the interest on the loans, let alone the capital.

The accounts for the year to 31 March 2021 showed stocks (part complete planning work) of £27m

This should have raised further questions around the business model.

- How is the re-payment being funded?

- Where did the rest of the £50m go?

2. What projects will deliver in the next 2 years and how much revenue will be generated?

In the September 2021 “Property Development Track Record” Godwin Developments presented 18 future projects. At that time, what was known:

- 9 – had an approved planning application,

- 3 – had just submitted a planning application

- 4 – just at concept stage

- 2 – Bletchley View, and Norton Business Park were not Godwin Developments Special Purpose Vehicle projects

This could have been considered to have been a healthy pipeline. The Gross Development Value of the 9 projects which had already received planning permission was £219m! However this significantly overstated the most likely outcome. The top 3 projects representing 80% of the expected income were:

Bendigo building (GDV £75m) – Godwin SPV GR no. 25 Ltd bought the property in June 2020 ( estimated to cost around £1-2m), and planning permission was secured on 19 August 2021. Godwins did not intend to continue with the build of the scheme. It was at the post-planning stage that they bailed out.

The land plus scheme was sold to Bricks Group in April 2022 for around £16m. A profit of the order of £15m for Godwin.

The Meridian building Sheffield (GDV £70m) – Godwin SPV GR no. 4 Ltd. – full planning permission was granted in August 2021.

By June 2022 the owner, Fairbank Investments had put the building up for sale and an alternative planning application submitted. This project has been excluded from subsequent Godwin reports.

Landmark Building, Derby (GDV £31m) Godwin SPV GR no. 2 Ltd – planning permission granted 2020, however it was frustrated by a UNESCO challenge over its size and location. By the end of 2021 it would have been prudent to have assumed that it was unlikely to complete in 2 years.

The other 6 were small schemes of a GDV of less than £10m each. They could only have netted a few million pounds between them and would not have been remotely substantial to support the business model. These 6 schemes ( to planning permission only) were delivered between 2022 and 2025.

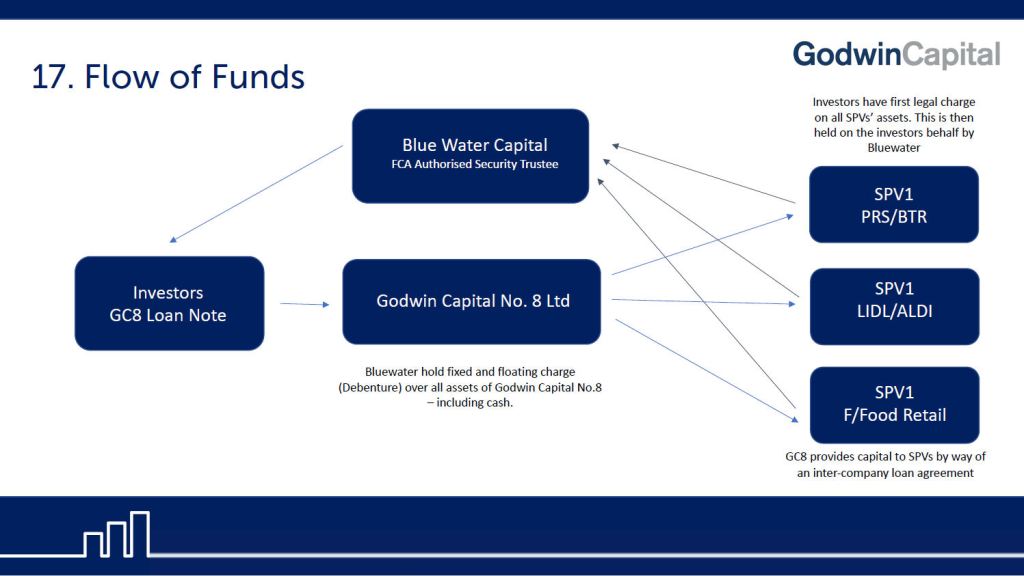

3. Were the 1st legal charges in place for the loans made by Godwin Capital no. 8 Ltd to the Godwin Special Purpose Vehicle companies?

This convoluted structure, first published in August 2020, confirms the plan for security. Godwin Capital no. 8 Ltd should have had 1st Legal charges (held by Blue Water Capital) on the loans it made to the various SPVs, This is the structure advertised to investors and who relied on this statement in their decision to invest.

By the end of 2021, these charges should have been evident on the Companies House website. This wasn’t the case. What was evident was that Godwins had borrowed additional monies from Together Commercial Finance Ltd which had, independent, 1st Legal charges on the assets of the various SPVs. There were 7 in place at the end of 2021, all registered at Companies House.

Any Adviser doing due diligence would have found this very easily; it should have set off alarm bells!

Comment

Potential investors rely on the efficacy of any documents issued, and advice given by approved and qualified people. When an Adviser claims that they have done due diligence then it is reasonable to assume that they have been diligent consistent with their espoused professional status.

Whilst an Investor must be careful, relying on professional advice, in complex situations, shows reasonable care.

The 3 questions I asked above were the basics ; dozens more could have been asked.

Investors were given the impression that the pipeline size, at the end of 2021, needed £50m to service it. That the operation during the previous 2 years was generating sufficient funds to cover all debts. The reality was that they delivered just 2 simple , “boiler plate” schemes netting petty cash.

80% of Godwin’s future pipeline was dependent on 3 projects which were substantially bigger and more complex than anything that they’d delivered before. That should have raised questions about risk. The due diligence should have focussed on the likely outcome of just those 3 and whether they had the capacity and experience to manage the growth

It was clear, well before the end of 2021 that the Landmark project was struggling. Derby News article from July 2019:

“Godwin’s ‘Landmark’ tower block plan – sliding to the right.”

And in June 2020: “Council approve “bland” Landmark building despite “harm” to local heritage. But will it actually be built?”

Shortly into 2022 the plan for The Meridian fell apart. Bendigo was the only development to sell with a small profit.

Many investors expected that Godwins would be involved in delivering the whole built scheme not just securing the planning permission and then selling out. In many cases it wasn’t even a Godwin company that was the applicant on the planning application, nor bought the land – they were just a contractor.

Investors weren’t investing into a company with a balanced 28 project portfolio across residential, commercial and roadside services; they were investing in just 3 projects with no risk-based analysis of the likelihood of success.

Godwins over-hyped their business to a gullible, greedy and predatory collection of Advisers who failed in their duty to be objective; seduced by the lucrative commission. Advisers who in turn recklessly mis-sold an investment proposition that had zero chance of success. Advisers who could have asked simple, but enlightening questions that would have encouraged healthy scepticism and informed investment decisions.

But to exacerbate the failure, none of the above answers the question as to where the money went. In September 2025, Godwin’s owe £150-£200m with very little in the way of assets to show for it. Unrealistic ambition is part of the story and the opportunity existed for people to spot it years ago, but, what appears to be a systematic draining of the companies’ bank accounts will determine whether this is a pre-meditated Ponzi-style scheme, or gross incompetence.

In the June 2020, Derby News article it concluded:

“Given that Godwins is funding these developments with 10%+ interest rate, high risk financial borrowing, it does raise the question whether these buildings will ever get off the ground….or worse, that the funding stream dries up part way through build.”

The demise of Godwin Developments could have been predicted with superficial due diligence by the Advisers. The irony is that a number of Advisers invested personally. Such was the extent of their incompetence, or greed.

2,500 people, who invested hard-earned personal wealth, into the Godwins “mirage” were recklessly mis-sold a proposition, bordering on deliberate deception, or possibly just collective gross incompetence, by their Advisers and Godwin Developments. Time will tell as to which it is.

Categories: Godwin