On March 13 2019, Derby News published an article called : Derby’s new Landmark building: Questions to be asked about the Property Developer, Godwin “group” which concluded:

“Godwins financial position, as per the last set of published accounts is very weak. Its project portfolio is not impressive – a few retail units and small housing developments does not indicate a robust track record for such a major undertaking. It has great ambitions to grow quickly which, whilst laudable, can bring huge cash flow problems – and Godwins does not have strong, inherent, positive cash flow.”

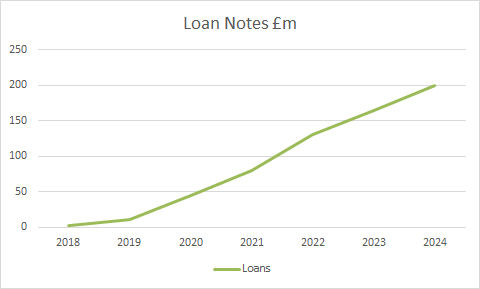

In June 2025, Godwin “Group” entered administration with thousands of individual Loan Note Holder (LNH) investors left with the prospect that they will lose all of their money, estimated at around £165m.

In Derby, the controversial Landmark building project on Phoenix Street, is still a car park and the Agard Street student accommodation was sold a few years ago to Marble Homes and is blighted with design issues.

Background

At the time of writing the article in 2019,Godwin’s experience was confined to a few modest housing developments and Roadside retail. It had just begun to attract investment via Loan Notes with a £10m issue on 16th April 2018 (Godwin Capital No. 2 Ltd) and a further £20m on 28th January 2019 (Godwin Capital No. 7 Ltd). These were loans for a fixed period of 2 years and attracted interest rates of 10-12%.

Loan Note invesments were made available to investors through a number of “Introducers” who took a commission, of around 10%; these were encouraged/recommended by “Advisors”. In the 2 year period of the loan, Godwin would have needed to have invested the loan note money in a development project , and then generated a sale at such a profit, to pay back, the loan, covering commission, interest and a profit for their shareholders, and support future investments.

The money from the LNH was initially lent to a Godwin Capital No. X Ltd company which in turn lent the money to separate Godwin limited companies, known as Special Purpose Vehicles (SPV) which, aggregated the costs of the project. There was 1 SPV per project in the format of, for example, GR no. 2 Ltd or GC no. 24 Ltd

As there were many thousands of LNHs, the management of the security, backing up the loan notes, was with Blue Water Capital Ltd/Blue Water Trustee Ltd, as Security Trustee. Their job was to act on behalf of all of the LNHs ensuring that all of the security was legally in place; but not that there was sufficient security!

In the first instance, the security for the loan (in 2019) was against the assets of Godwin Capital no.2 Ltd ( and no. 7). As their only asset was a loan to the separate SPV, there should have been a back-to-back fixed charge between the relevant Godwin Capital company and the SPV. This was not done, rendering the loans unsecured!

What was not evident to the LNHs was that the SPV had taken out separate 1st legal charge loans with 3rd party finance companies.

- One of the early projects, the Ram Jam Roadside service area (SPV – GC no. 24 Ltd) , was launched in March 2018, backed by a legal mortgage with Callidus Properties Ltd. This was rolled over into new loans in October 2023 from Together Commercial Finance Ltd, with a fixed charge of £4m over specific title deeds.

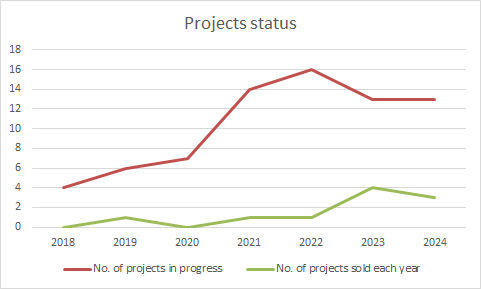

In 2019, Godwin had 6 projects in different stages of completion only 1 was sold within 2 years (May 2020)

- The Rushden Service station development was a 2 year project and was sold in May 2020. Godwin took the project just through the planning phase ( it is noteworthy that Eurogarages was the applicant, not Godwin) and then sold it to LondonMetric Property, for just over £2m. The site was built by Eurogarages – not Godwin!

And then later:

- Godwin’s had to wait until April 2022 for its next sale which was another Roadside retail site in Stoke which was also sold for around £2m.

In the period from 2019 to 2021, the pipeline of projects increased from 6 to 14.

The loan note money was being used to fund planning work on other projects, as well as broader “administrative costs”. Loan notes needed to be paid back. Further loan notes to the value of £25m were issued on 30th November 2019, and then a further £50m on 12th October 2021.

6 projects were completed in 2022/23. There is little transparency of how much profit was made on these projects.

Summary

The ambition to launch projects and grow the business was not met by projects being sold so there was negative operational cash flow . The value of sales were insignificant compared to the monies borrowed. The black hole deepened and from 12 October 2021, Godwin ramped up the level of borrowings through more loan notes.

What is the Godwin “Group”?

The fallacy about the Godwin “Group” is that there is no group.

There are no accounts that consolidate all of the 100+ companies that are owned by the 4 Godwin Director/Shareholders. It is impossible to get a good understanding of the total group position apart from constructing it by manually examing each set of accounts.

Derby News compiled a detailed spreadsheet of every Godwin/common ownership company to establish the overall status. Through detailed analysis of the planning applications, individual projects were correlated with the Godwin SPVs.

In 2015, the net liabilities of the SPVs was £0.4m ( technically illiquid). Those net liabilities continued to get worse. By 2019 it had become £6m ; by 2021 £17m ; and then by 2024, £68m. This assumes that all of the assets were worth their book value.

Administration

The inevitable happened in June 2025 when the administrators were brought in on a discrete number of the Godwin companies, but, significantly, not the whole “Group”. The main defaulter was Godwin Capital no. 8 Ltd.

The LNHs of Godwin Capital no. 8, Ltd had invested on the strength of a well advertised 1st Legal Charge on the properties .

It has become evident to the LNHs that the assurances about the extent of the security, given by Godwin, the Introducers and Advisors were incorrect.

Ther report from the Joint Administrators, MHA, dated 15 August 2025, stated:

“…funds advanced in respect of property developments to the SPVs were to be secured by debentures as security for such loans but, from information obtained to date, this security was not obtained and any such funds advanced are unsecured debts”

As reported above, and discovered by the Administrator, many of the SPVs had wholly separate loans to fund the property purchases which would take precedence over the loan note investments. The recovery of those loans is already in progress.

- The Ram Jam Service area project which is still owned by GC no. 24 Ltd has already been the subject of a Liquidation report which confirms that the 1st Legal charge is with Together Commercial Finance Ltd. The property will realise £5.1m of which £4.4m will be paid to Together Commercial Finance Ltd. Money that the LNHs expected would contribute towards repaying their loans.

- Similarly CL no. 2 Ltd which was the SPV for the Ely, Cambridge housing project was the subject of 6 1st legal charges (Aug/Sep 2023) from Together Commercial Finance Ltd for around £3m. These loans were fully satisfied and paid off on 30th June 2025, after the start of the Administration proceedings.

- GR no. 9 Ltd, the SPV for the Maple Fields development which was subject to 2 1st legal charges from Together Commercial Finance Ltd (May / Jun 2024) for around £2m; these were paid off and satisfied on 30th June 2025.

- GR no. 2 Ltd, the SPV for the Landmark development in Derby which was the subject of 3 legal charges (Dec 2020, Aug 2023) from Together Commercial Finance Ltd for at least £1m.

MHA has reported that the presence of these other secured loans will impact the recovery for the LNHs

“Unfortunately, in 4 of these cases, there are third party secured creditors who have appointed either Administrators or Fixed Charge Receivers to protect their interests and recovery in respect of these loans (approx. £16m) is considered doubtful. We will however monitor the outcomes in the event that position changes/improves”

It is a fact that the Godwin corporate structure does not lend itself to transparency. LNHs relied on the integrity of the statements made by their Financial Advisors, Introducers and from Godwin themselves. Most of those offering advice were regulated by the Financial Conduct Authority (FCA) and assured their clients that they had done the appropriate level of due diligence.

In some cases, the due diligence seemed to have been confined to a scan of news reports.

Godwin will have known that the LNHs would have no security over the property despite asserting that. It was Godwin’s who contracted with 3rd party funders whose security was in direct conflict with the Loan note security.

Prospects

Derby News’ investigation confirms that at 31 March 2024, the book value of the SPVs stock was just £71.4m. It is unlikely that this will be fully realised given that:

- At least £16m is held as security for the 3rd party loans

- Accrued costs may not be relevant to a buyer.

- For example, Landmark stock is shown at £8.1m; the land cost was £1.6m – it is still undeveloped land. The additional £6.5m can only be associated with costs of developing the plans and taking it through the planning application process. This is only valuable if someone plans to build a 17 storey block of flats.

- The Ram Jam Services development has a book stock value of £7.1m; the liquidators estimate its realsiable value at £5.1m – a loss of 30%!

In addition to the stock, the combined SPVs have “debtors” of £103m however the accounts do not explain what this relates to. Most of the SPVs have not had any sales; these are most likely intercompany transfers, or residue costs not yet taken to the profit and loss account with no realisable value.

- The Bendigo building was sold to Bricks Group in 2022, yet the SPV GR no. 25 Ltd shows “debtors” of £4.1m. It is unlikely that this is realisable.

Comment

The collapse of Godwin “group” was entirely predictable – it was just a matter of time.

Borrowing £200m, whilst developing small roadside retail sites was never going to be sustainable. The other housing developments were small. The 783 unit Bendigo building in Nottingham was the largest sale despite only taking it to planning permission stage; that was around £20m gross sale value.

The myriad of “Introducers” and “Advisors” who claimed that they had carried out due diligence were, at best, incompetent, and failed in their professional responsibility. Some will have had a personal financial incentive to encourage people to invest, which raises questions as to whether they consciously ignored the true financial prospects.

According to the Administrators in their report of 15th August 2025:

“The Directors have stated that they first identified adverse trends in the inflows and outflows across the Group in January 2024.”

It is difficult to believe that a competent finance professional would have taken until Janury 2024 to identify that “trend”. Of course, to avoid prosecution it would need to have been after the Godwin Developments “Property Track Record” document published in November 2023.

The Derby News investigations which analysed every company in the “group” including every company owned by the Pratt brothers, established that not one of them had net assets ( apart from the shell dormant companies showing £100).

It is obvious based on the timing of the maturity of the loan notes, and the lack of sales, that new Loan Notes were, in part, used to pay off maturing Loan notes.

The Administrators stated in their 15th August 2025 report:

“Funds also appear to have been loaned to enable repayments of loan notes issued by other Godwin capital raising companies (approx. £24m)”

It was, basically, a Ponzi scheme

The 12 Godwin Capital companies owe close to £200m (at 31 March 2024), of which £165m is in Godwin Capital no. 8 Ltd. Ignoring the reported “debtors” which are most likely to be inter-company, and not realisable, the stock/ work in progress assets available to LNHs will be a maximum of around £50m – most likely considerably less. Derby News believes that all costs associated with a project, and possibly more, will have been booked to stock which, in a liquidation, will have little value.

The most suspicious SPV inflating the stock by £22m is GR no. 31 Ltd. This cannot be correlated with any of the advertised Godwin projects.

The Joint Administrators summarise the reality of the situation:

“The realisable value of these unsecured loans remains uncertain at this stage, as it is not yet clear which SPVs within the Group hold physical properties and what recoveries may be possible in this regard. However, at this stage, it would appear that recoveries from these assets will be minimal as against the quantum of the funds loaned to the operating companies and SPVs and this matter will require significant further investigation.”

Derby News concluded the 2019 article by saying:

“There is a real risk that this could be a very tall, “white elephant” or a great project floored by unsubstantiated ambition.”

For the people of Derby, it is the latter, and a half built monstrosity doesn’t blight the historic skyline.

For the 2000+ LNHs who have been mis-sold investments, with the prospect of losing a considerable amount of money, they will be looking for a full criminal investigation to bring to justice not only the 4 Directors, but also the range of Introducers and Advisers who were reckless, or fraudulent, in their professional duty.

Postscript

It is notable that the Godwin Developments website is off line, as is that of the main Loan Note promoter, Capital 3PM.

In an interview with International Investor on May 20 2022, the MD of Capital 3PM, Adam Davis, explained:

” …to be frank with you we wanted us, and our clients more importantly, to sleep well at night and the way to do that in our opinion is to have an element of fixed income in your investment portfolio. The more you have in theory the more conservative you are as an investor so for us it was all about how can we distribute effectively a product where our clients will sleep well at night if they do, then we do, so you know we wanted to kind of miss all of the noise and all of the excitement of the market “

Therein lies the problem – Fixed Income does not mean Low Risk!

Categories: Godwin

The Derby News investigation into the Godwin Group is most impressive. Have you ever considered investigating why First Investments have owned the grade one and grade two listed Belper Mills since 2004 without carrying out any significant repairs or maintenance leaving the UNESCO WORKD HERITAGE SITE vulnerable to

In January 2004 the ownership changed to Carfrae Holdings Limited – also of Chorley and registered in Jersey. Price stated £2, 979,999 (Charge dated 1 February 2006 in favour of Deutsche Bank – lender) Managed by FI-REM

In January 2016 ownership changed again to GHL Property Management and Development Limited also incorporated at the same address in La Pouquelaye, St Helier Jersey and managed to FI-REM a registered private company that was founded in 2004. Price stated £250,000. No lender.

The assumption is that, like Britannic Business Parks, both Carfrae Holdings Limited and GHL Property Management and Development Limited are owned by Tim Knowles. (It is not possible to check this for companies registered in Jersey in the same way as companies registered in the UK that are on the Companies House register.)

The latest (2023?) annual accounts for FI state that the ‘ultimate parent company’ is Acepark Ltd and the ‘ultimate controlling party’ is TJP Knowles.

An excellent piece of journalism, highlighting a malignancy in the investment world that remains unchecked.

The report was compiled with assistance and information provided by members of the https://www.facebook.com/groups/716018601039898/. We exist with the sole purpose of providing a united front to investigate and recover what we can from these people who believe that defrauding individuals is an acceptable means of conducting their business. We want to identify them and bring them to justice and warn others about the perils of becoming involved in such schemes.

If you are a victim please join us.