The bad-tempered 5.5 hr Council meeting on Wednesday 26th February 2025 achieved very little for the City

Questionable claims and confusing counter accusations were obscured by venomous politicking.

Has the Council been boosted by £22.6m of new money from the Government, would the Labour Party’s original budget be the only way forwards, did the opposition achieve anything for the tax payer, and is the Council on the brink of collapse?

What are the facts?

Council Tax

The income for the Council ( excluding Schools) is planned to be £350m for 2025/26; of which around £133m comes from the Council Tax (38%) – the rest is from a range of specific grants provided by Central Government.

The headline percentage increase in Council Tax is calculated by a convoluted route – this is defined by law..

The Council defines its budget requirement (£350m); it deducts the money committed by central Government (£219m) to arrive at the Council Tax requirement (£133m). This is divided by a number which is the “weighted average Band D equivalents” (the tax base is 73139.57 – there are actually only 8,897 Band D properties); this is not just the number of physical houses in Band D but derived by a complicated algorithm.

The Council Tax paid by each Band is a statutorily defined proportion of the Band D amount; for example Band A is 5/9 of Band D.

Derby City Council’s problem is that 85% of the properties in the City are Band A-C which means that when the maximum tax increase of 4.99% is applied it will generate less income than if they were all Band D’s, for example. In simple terms, this is why Derby City Council needs to increase the Council tax by the maximum each year to keep up with inflation and greater social care demands.

The paradox is that the total amount of money paid by Derby Council tax payers will increase by 5.9% from 24/25 to 25/26, not 3.99% – largely due to house building. If the number of properties ( and the tax base) remained unchanged from last year to this year, then there would be a budget shortfall of £2.3m!

3.99% vs 4.99%

The net result of the 5.5 hr Council debate is that the Council tax will rise by 3.99% rather than 4.99%.

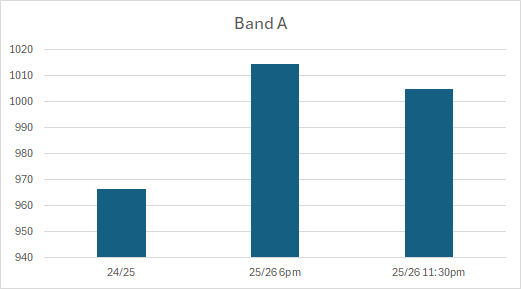

At 6pm on Wednesday, the 52% of properties in Band A, were due to be subject to a Council Tax rise of £48.22 pa, from £966.30 to £1014.52. The Tory amendment to reduce the increase to 3.99% saved Band A residents – just £9.66 pa – 19p per week!

The Tory leader Cllr Hassall initially called for a 0% rise in Council Tax. This would have resulted in a budget shortfall of £5.1m.

Did Derby City Council get £22.6m extra money from the Labour Government?

In addition to core grants, Councils receive a range of “Specific Grants” which promote policy initiatives from Central Government; principally these are around public health and social care.

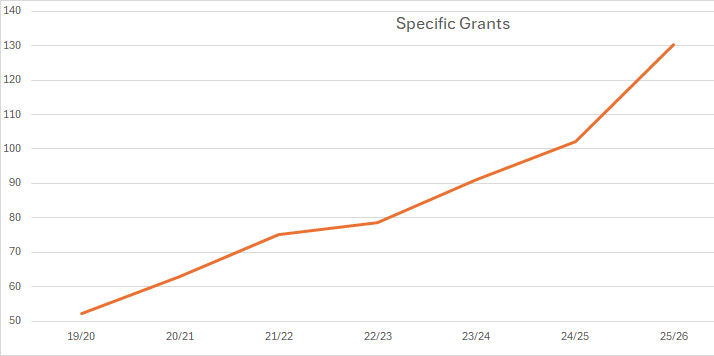

The amount received by DCC has grown year on year, from £52m in 2019/20 to £130m in 2025/26

In 2025/26 the total amount of specific grants will be £130m; this is £28m higher than the previous year. Based on a 5 year trend then the Council would have expected a substantial increase, in any case – on a straight line basis ~ £115m.

This would suggest that the £130m in 2025/26 includes a ~£15m bonus from the Labour Government.

The Council’s budget paper states in 1.1.3

“For Derby, the Core Spending Power increased by £22.6m…”

4.6.1 confirms:

“The Government, in its definition of Core Spending Power for Local Government, assumes that Councils will recommend the maximum increase to support service delivery”

The additonal funding from the Council Tax is around £8m which, together with the £15m new grant funding = £23m (cf £22.6m)

Will the lower Council Tax rise make any difference to services?

A 3.99% rise in Council Tax, rather than 4.99% will reduce the Council’s funding by £1.27m

Taken in isolation, this is a lot money and much could be achieved with it. However, this does assume that budgetting is an exact science and that every penny is accounted for – this isn’t the case. What is presented is a PLAN – not a piece of DNA.

The budget of £350m makes a multitude of assumptions about inflation, pay rates, additional demands on services, cost of fuel, heating , material etc. All of which are unknowns and any adverse outturn may create more pressures on the budget or conversely create opportunities.

£1.27m is barely measurable in a sum of £350m – it represents just 0.36% of the total. Budgetting to an accuracy of 99.64% would be considered a success by most organisations.

In short, it won’t make any noticeable difference to services.

Despite this, only £340m of the £350m funding is planned to be spent on services; the other £10m will be used to replenish reserves. This suggests that if there is £1.27m less income from Council Tax that service levels don’t need to be impacted, just less money transferred to reserves.

Brink of collapse?

Unearmarked general reserves are low against previous highs and need increasing, however there is a difference between this technical accounting position and whether the Council is heading for bankruptcy due to the loss of £1.27m. The Council has over £60m in reserves and has buffers in place – it is not on the brink of collapse.

Comment

The 5.5 hrs Council meeting was a demonstration of time wasting due to petty politicking. Most of the speeches were given by Cllrs with a primitive level of knowledge of Council budgetting and with little sense of reality or experience in managing a large organisation. The abundance of cliches and trite political generalisations had all the hallmarks of the output from a cheap AI speech writing app.

When:

- 60%+ of the Council’s expenditure is on Adult and Children’s Social Care which is subject to an ever increasing statutory demand, and

- The Council’s budget reserves are at a record low.

Common sense would say that the Council should increase the Council Tax to the maximum to ensure that all demands for social care can be met, and that the Council recovers some financial resilience. The difference between a 3.99% and 4.99% increase is irrelevant to the Council tax payer costing a few pence a week – and those most in need will get help through Council Tax support.

The headline figure of a £22.6m “boost” has clearly been inflated by the Council Tax increase which is a little disingenuous. However, there has been substantial (~£15m) new grants which will make a difference – provided it is routine.

As part of the “deal” by the opposition parties to secure a balanced budget, the plan had to include £1m capital for parks – this seemed like a random suggestion from the Council chamber with little basis in strategy.

Over the years, both parties have played politics with the Council Tax increase. It would make more sense if they increased it by 4.99% each year as a matter of policy and save a lot of time and pointless arm-waving. The City needs it!

Categories: Uncategorized