Derby City Council’s Chief Executive, Paul Simpson, stated at the Cabinet Meeting on 12th September 2023,:

“The council is not cash-poor. We are resource-poor in the sense that it is our revenue funding that’s the problem. We do not have a shortage of cash – we are relatively a cash-rich organisation on the basis that we are getting council tax, business rates and income from car parking charges.”

“We are relatively a cash-rich organisation”

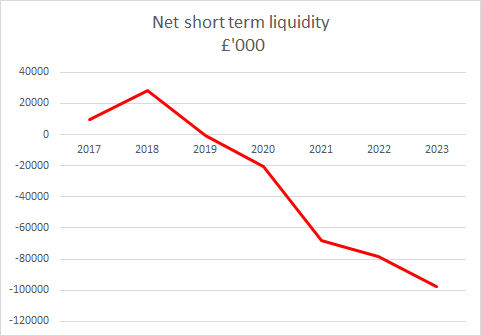

Being “cash rich” is normally judged by reference to how much cash, or cash equivalent investments ( not property, or long term fixed investments) one has, less immediate term creditors, or loans ( net short term liquidity)

At 31 March 2018, the Council’s net short term liquidity was £28.3m. In the subsequent 5 years that position deteriorated, year on year, to the extent that the Council has a negative net short term liquidity of £97.4m!

- Birmingham City Council which has just gone into ‘bankruptcy’ (s114 notice) was running with a negative net short term liquidity of £385m. Other councils who have declared a similar s114 position had significant negative net short term liquidity:

- Woking Borough Council negative £230m

- Croydon negative £50m.

- Thurrock negative £988m

- Councils close to declaring a s114 notice:

- Kirklees negative £131m

- West Berkshire negative £54m

Conversely :

Leicester City Council has positive net short term liquidity of £5m. Sheffield City Council is positive by £70m

The Council hemorrhaged £125m of cash in 5 years; most of this was invested in property, and equipment. There is no evidence that this is returning some financial benefit to the Council.

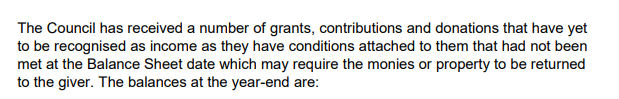

The long term financing has remained relatively constant over the 5 years however the source has changed significantly. The use of finance leases and borrowing has dropped by £46m to £397m. The counter to this is the £42m increase in the advanced receipt of Capital Grants, to £70.5m – which is money held on trust – as opposed to contracted liabilities where repayment is defined. Note 14 to the annual financial statement states:

No comment is made about the assessed risk of the money having to be returned in the short term.

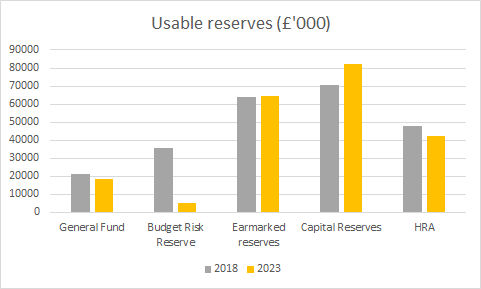

The consequential effect of the above financial mismanagement, on the balance sheet, is a £26.7m reduction in usable reserves which is predominantly in the Budget Risk Reserve ( used to fund in year overspends). This reserve dropped by £31m from 2018 – 2023; it is forecast to fall by a further £5m, to zero, by 31 March 2024 based on current projected overspends. A total reduction of £36m in 5 years!

Comment

By Simpson’s definition, anyone who receives an income is “cash rich”; what he fails to mention is that the Council’s costs exceed its income, routinely, which makes it a cash drain. This, he seems to imply, is a separate issue to cash, by using the term “resource poor” – this is grossly misleading.

The Council is a service organisation. It gets cash from the Council Tax payer, business rates, some services, and from Central Government, and it then spends cash. It does not manufacture anything or sell “added value”. It’s cash in / cash out at it’s simplest level.

If in 2018, all of the Council’s short term creditors wanted paying, immediately, it could have done so from cash in the bank – that is “cash rich”. In 2023, the Council would have to sell property/assets, or borrow money, to generate the cash – this is NOT being “cash rich”.

There is little scope to generate surpluses to replenish the depleted cash reserves other than through (theoretically) long term borrowing.

The Chief Executive, the Chief Finance Officer and the Tory administration were fixated with “balancing” the in year revenue budget with dubious book-keeping whilst ignoring the reality that the Council was running out of cash. Cash is finite, it can’t be revalued, or inflated by a technical book transaction – it is reality. It is the financial lubricant for the Council’s operation – without it, the system grinds to a halt and many Councils are now finding that out.

The Council has, in effect, used short term financing to fund long term capital investments which are not generating an income/cost saving to the revenue budget of a sufficient size/rate to pay itself back.

A commercial organisation can inflate prices, extend market reach etc to increase income and make more profit to recover a deficit, a Council is bound by legalities that restrict the growth in Council Tax and require a balanced budget to be approved which implies no surplus ( or minimal surplus). A balanced budget implies a balanced cash budget as well – something that the Council seems to have overlooked.

I have written on many occasions that the financial management of Derby City Council has been incompetent. Nothing has ever made any sense. In the last 5 years under the Tories, the budget has been manipulated through opaque movements in reserves and a long list of unachievable savings – it was balanced on paper only.

It seems that Paul Simpson doesn’t even realise how dire the situation is at Derby City Council. A Chief Executive who’s advising the Cabinet that the Council is “cash rich” when, in reality, it’s on the verge of ‘bankruptcy’ is completely incompetent and it is a gross dereliction of duty – he should be removed from office!

Postscript

In 2012 the outgoing Chief Secretary to the Treasury, Liam Byrne, left a note to his successor which simply said, “There’s no money left”. The outgoing Tory administration in Derby could have followed the same practice!

Categories: Uncategorized

Why does Local Government employ people in Senior positions, who run the canteen in Private industry?

Written by someone who has complete bias against Conservatives….

Of course, Paul Simpson is a paid Officer and not a Conservative Councillor. The financial situation is a matter of public record.